Management Discussion and Analysis Report

Al Anwar InvesEstablished in 1994, Al Anwar Investments SAOG (AAI) is one of the premier investment companies listed on the Muscat Stock Exchange (MSX). Over the past 31 years, the company has played a key role in founding several successful businesses, including Al Maha Ceramics SAOG, Voltamp Energy SAOG, and Arabia Falcon Insurance SAOG. Al Anwar’s investment portfolio is well-diversified across multiple sectors, such as banking, manufacturing, insurance, and education.

The Board of Directors has approved a five-year strategic plan, under which AAI aims to grow its asset base significantly over the next 2–3 years. This growth will be driven by raising paid-up capital, borrowing additional funds, enhancing the value of its existing investments, and deploying capital into new opportunities.

INVESTMENT STRATEGY: CLEAR, DIFFERENTIATED AND PROVEN

AAI is a significant minority shareholder in several private and publicly listed companies in Oman. AAI follows a private equity model of investing and is an active investor. Al Anwar invest in companies with the intention of improvingthe business performance and enhancing the value of the company.

Al Anwar mission is to support, create and nurture successful entities which create and enhance long term value for the stakeholders through:

- Investing in companies with scalable, creative, and sustainable Business Models.

- Enhancing Corporate Governance and ensuring adequate systems and procedures.

- Focusing on execution and operational excellence.

OMAN ECONOMY AND OUTLOOK:

- In 2024, Standard & Poor’s upgraded Oman’s credit rating from “BBB-” to “BB+” with a stable outlook. This upgrade marks Oman’s return to investment-grade status after nearly seven years, reflecting significant improvements in public finances, fiscal discipline, and economic reforms.

- In 2024, Oman’s economy demonstrated resilience amid global challenges, buoyed by structural reforms and continued diversification efforts under Vision 2040. Although overall GDP growth slowed to 1.2% due to oil production cuts under the OPEC+ agreement, the non-oil economy expanded by 3.8%, driven by strong performance in construction, manufacturing, and services. The medium-term outlook remains positive, with institutions like the World Bank projecting GDP growth of around 3.0% in 2025–2026 as oil output gradually recovers and diversification deepens.

- Oman’s fiscal and external positions strengthened significantly. The country recorded a budget surplus of 6.2% of GDP, supported by disciplined fiscal policies and improved non-oil revenues. The current account surplus reached 2.4%, and public debt dropped to 35% of GDP, reflecting efforts to reduce fiscal vulnerabilities.

- Inflation remained low, averaging just 0.6%, because of declining food and transport costs, and the Omani rial’s exchange rate peg continued to anchor price stability effectively.

- Oman’s government is actively implementing reforms aligned with Vision 2040, including improving the business environment, enhancing labor market flexibility, and accelerating digital and green initiatives. However, risks remain, including global oil price volatility, geopolitical uncertainties, and potential delays in structural reform execution. Nonetheless, Oman’s outlook is increasingly stable, supported by improved credit ratings and growing investor confidence.

PERFORMANCE OVERVIEW OF MUSCAT STOCK EXCHANGE INDEX (MSX):

In the last 5 years MSX 30 Index increased by 28% from 3,425 in April 2020to 4,367 in March 2025.

OPPORTUNITIES

AAI remains cautiously optimistic about the outlook for Oman’s economy. We recognize that the current economic environment presents a strategic opportunity to invest in sectors poised to benefit from the country’s ongoing growth and diversification efforts. Guided by our long-term investment approach, we aim to align our capital deployment with national development priorities while generating sustainable value for our stakeholders.

5 Year Strategy

AAI Board has approved 5-year strategy aims to increase its asset base to OMR 100 million. The strategy is focused on the following key objectives:

- New investment in growth sectors:

AAI aims to capitalize on new opportunities, with a primary focus on the banking sector. Over the past two years, the Company has significantly increased its exposure to this sector—from 2% to 38% of total assets. This strategic shift has delivered strong results, including enhanced returns, higher dividend income, and improved portfolio diversification.

Beyond banking, AAI is also targeting select investments in the industrial sector. The focus will be on businesses expected to benefit from an improving economic environment, particularly in building materials, chemicals, equipment manufacturing, food manufacturing, and fast-moving consumer goods (FMCG). These sectors are well-positioned for long-term growth and align with AAI’s objective of generating sustainable value across its portfolio.

- Enhance profitability of associates

AAI as an active investor is committed to enhancing the profitability of its associate by supporting the boards of its associate companies in implementing strong corporate governance, improving senior management capabilities, and optimizing operational costs. The strategy also focuses on expanding business capacity, pursuing mergers and acquisitions, and forming strategic partnerships to drive growth and foster synergies. As a result of the above initiatives and due to other favorable outcomes, the profits from a number of AAI associate companies have improved substantially in the last 3 years. Several other initiatives are currently being executed by each of AAI associate companies which should lead to further enhancements of profits within the next 5 years.

- Divestment and Portfolio Diversification:

AAI seeks to maximize returns by exiting investments which have matured and recycle the proceeds in investments which will enhance long-term returns and diversify its portfolio.In line with this strategy, AAI has divested a 9.8% stake in Voltamp Energy during the year, while retaining a significant influence over the company.

4. Fund raising:

Al Anwar plans to raise additional funds to capitalize on existing investment opportunities. The fund-raising plan is as follows:

- OMR 10 million in 2 rights issues: AAI has successfully completed the first Right issue of OMR 5mn in the year 2024-25.

- OMR 20-30 million in debt which may include a bond issue of OMR 10 million to be issued in the next 2 years and additional bank debt

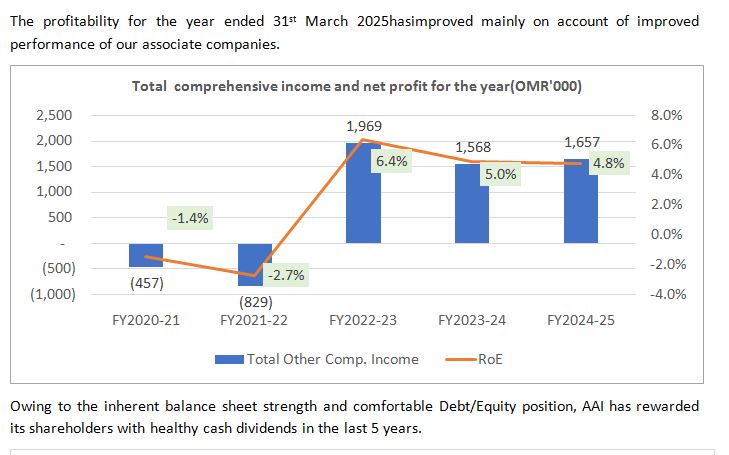

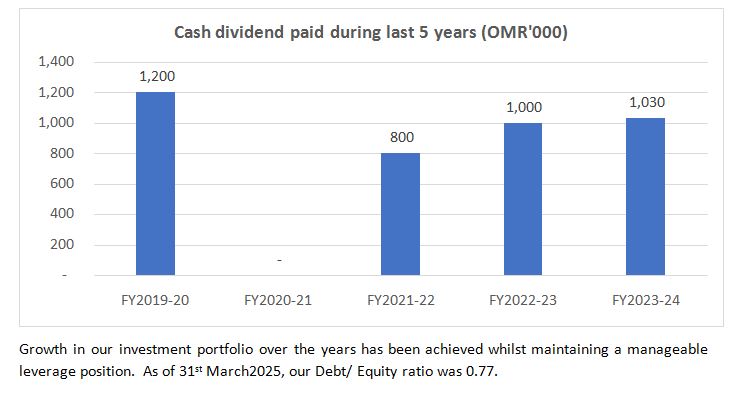

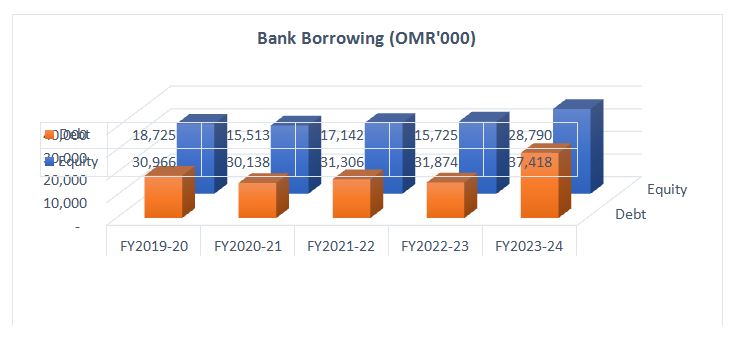

PERFORMANCE ANALYSIS

INVESTMENT PORTFOLIO

Al Anwar Investments SAOG (AAI) maintains a well-diversified portfolio across key sectors including Finance, manufacturing, insurance, and education. As part of its strategic review for the period 2024–2025, the AAI Board has realigned its investment focus, shifting emphasis from manufacturing to banking. Reflecting this strategic pivot, AAI’s exposure to the financial sector increased significantly—from 38% as of 31st March 2024 to 56% by 31st March 2025.

The Company continues to benefit from strong performance in both its manufacturing and financial clusters, which have consistently delivered solid returns. In addition, our education sector investments hold promising long-term growth potential, in line with national development priorities.

AAI follows a long-term investment philosophy, aimed at enhancing profitability and steadily increasing the intrinsic value of each of its holdings. Our strategic focus remains on maximizing shareholder value through disciplined capital deployment and active portfolio management.

Our investment portfolio as of 31st March 2025by clusters is as follows:

RISKS AND CONCERNS

AAI has a robust Risk Management framework in place that adheres to industry best practices. Risk Management is embedded in all core business functions and is an integral part of the business strategy. AAI follows a proactive Risk Management approach in remediating internal and external risks through conducting regular risk assessment of its portfolio companies, operating environment and taking proactive action to mitigate emerging risks.

Risk issues impacting portfolio companies are proactively managed through close working relationships with investee companies and the prudent oversight of our Board representatives. Broadly, these risks take the form of increasing costs/ decreasing margins, competition from other sources of supply and shifts in customer preference for other solutions. Also, each of the investee companies have their own risk management process in place.

ACKNOWLEDGMENTS

We acknowledge the contribution of our Board Members for their wisdom and valuable guidance which has helped us in successful implementation of our strategy. Further, we appreciate the confidence entrusted by our shareholders.

Khalid Al Eisri

Chief Executive Officer