Al Anwar InvesEstablished in 1994, Al Anwar Investments SAOG (AAI) is one of the premier investment companies listed on the Muscat Stock Exchange (MSX). Over the past 31 years, the company has played a key role in founding several successful businesses, including Al Maha Ceramics SAOG, Voltamp Energy SAOG, and Arabia Falcon Insurance SAOG. Al Anwar’s investment portfolio is well-diversified across multiple sectors, such as banking, manufacturing, insurance, and education.

The Board of Directors has approved a five-year strategic plan, under which AAI aims to grow its asset base significantly over the next 2–3 years. This growth will be driven by raising paid-up capital, borrowing additional funds, enhancing the value of its existing investments, and deploying capital into new opportunities.

AAI is a significant minority shareholder in several private and publicly listed companies in Oman. AAI follows a private equity model of investing and is an active investor. Al Anwar invest in companies with the intention of improvingthe business performance and enhancing the value of the company.

Al Anwar mission is to support, create and nurture successful entities which create and enhance long term value for the stakeholders through:

AAI remains cautiously optimistic about the outlook for Oman’s economy. We recognize that the current economic environment presents a strategic opportunity to invest in sectors poised to benefit from the country’s ongoing growth and diversification efforts. Guided by our long-term investment approach, we aim to align our capital deployment with national development priorities while generating sustainable value for our stakeholders.

AAI Board has approved 5-year strategy aims to increase its asset base to OMR 100 million. The strategy is focused on the following key objectives:

Beyond banking, AAI is also targeting select investments in the industrial sector. The focus will be on businesses expected to benefit from an improving economic environment, particularly in building materials, chemicals, equipment manufacturing, food manufacturing, and fast-moving consumer goods (FMCG). These sectors are well-positioned for long-term growth and align with AAI’s objective of generating sustainable value across its portfolio.

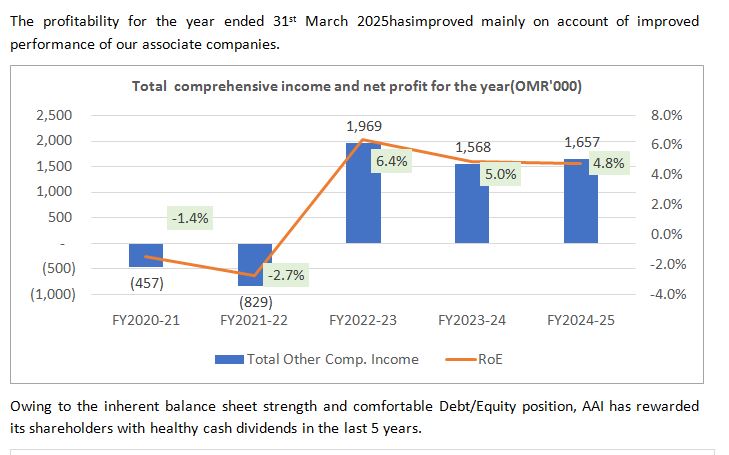

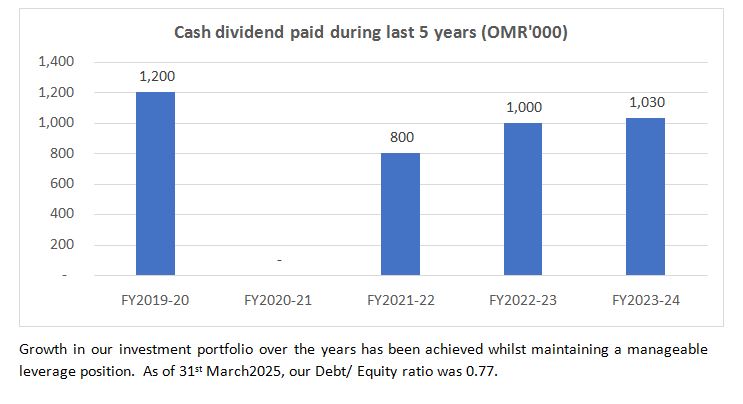

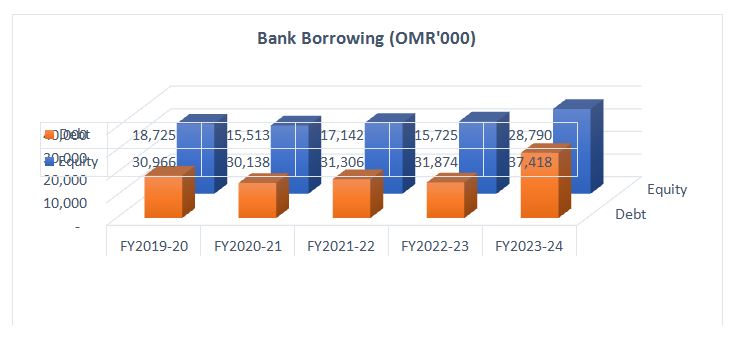

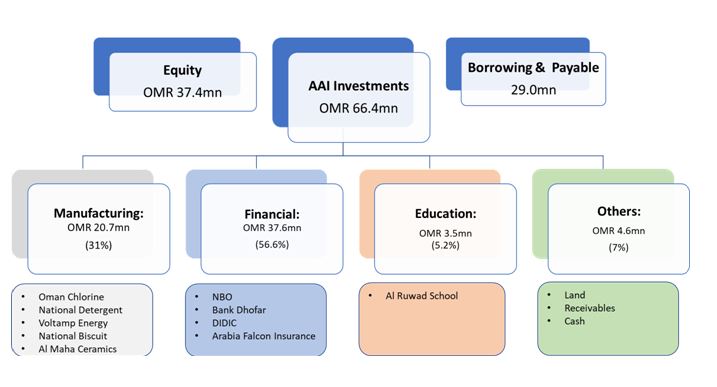

Al Anwar Investments SAOG (AAI) maintains a well-diversified portfolio across key sectors including Finance, manufacturing, insurance, and education. As part of its strategic review for the period 2024–2025, the AAI Board has realigned its investment focus, shifting emphasis from manufacturing to banking. Reflecting this strategic pivot, AAI’s exposure to the financial sector increased significantly—from 38% as of 31st March 2024 to 56% by 31st March 2025.

The Company continues to benefit from strong performance in both its manufacturing and financial clusters, which have consistently delivered solid returns. In addition, our education sector investments hold promising long-term growth potential, in line with national development priorities.

AAI follows a long-term investment philosophy, aimed at enhancing profitability and steadily increasing the intrinsic value of each of its holdings. Our strategic focus remains on maximizing shareholder value through disciplined capital deployment and active portfolio management.

Our investment portfolio as of 31st March 2025by clusters is as follows:

AAI has a robust Risk Management framework in place that adheres to industry best practices. Risk Management is embedded in all core business functions and is an integral part of the business strategy. AAI follows a proactive Risk Management approach in remediating internal and external risks through conducting regular risk assessment of its portfolio companies, operating environment and taking proactive action to mitigate emerging risks.

Risk issues impacting portfolio companies are proactively managed through close working relationships with investee companies and the prudent oversight of our Board representatives. Broadly, these risks take the form of increasing costs/ decreasing margins, competition from other sources of supply and shifts in customer preference for other solutions. Also, each of the investee companies have their own risk management process in place.

We acknowledge the contribution of our Board Members for their wisdom and valuable guidance which has helped us in successful implementation of our strategy. Further, we appreciate the confidence entrusted by our shareholders.

Khalid Al Eisri

Chief Executive Officer